ABOUT US

- ABOUT SEIBU REAL ESTATE

- TOP MESSAGE

- SUSTAINA

BILITY ACTION - COMPANY PROFILE

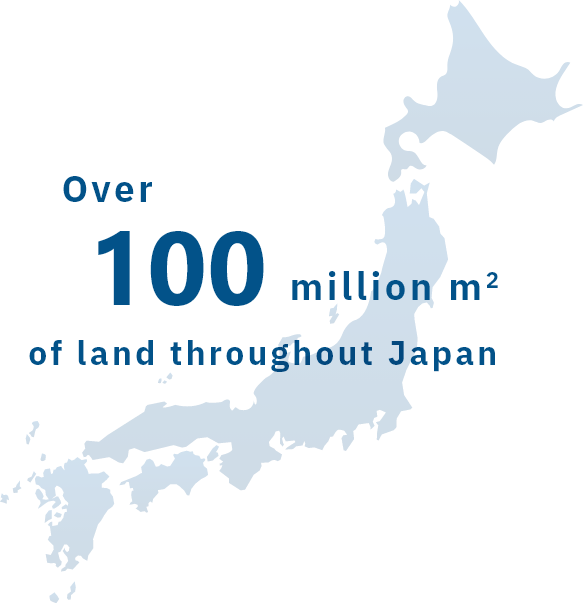

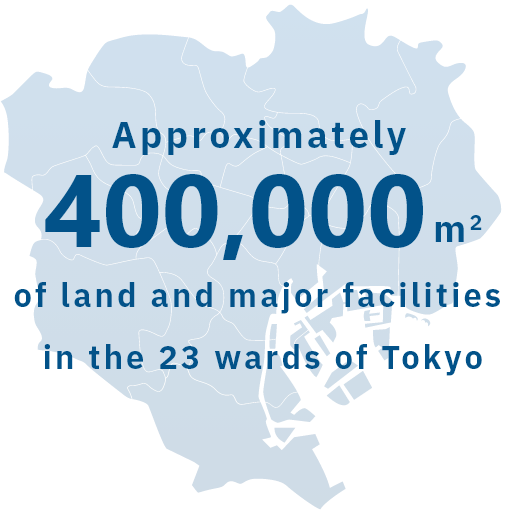

Assets of the Seibu Group

Mission

SEIBU REAL ESTATE will extract the maximum value from our real estate holdings, and contribute to optimizing the balance of the businesses and assets of the Seibu Group as a whole.

- We will boldly take on new challenges with a frontier spirit, and fulfill our mission as a core growth strategy"

- We will take responsibility for managing real estate holdings, and unlock the latent value of real estate through development and securitization

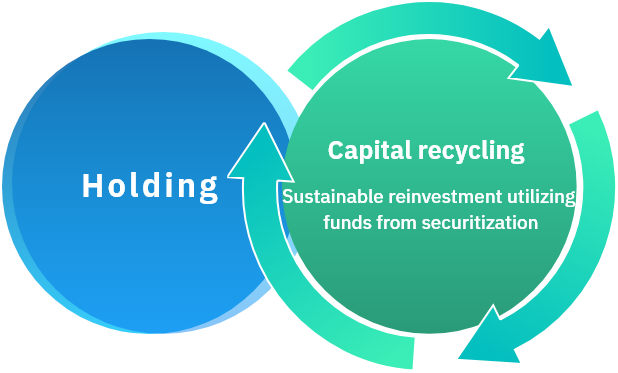

Achieve growth both through "holding" and "capital recycling

(sustainable reinvestment utilizing funds from securitization)"

As we target enhanced growth that is also sustainable, we will shift from our existing holding-based business model, to a business model that achieves growth by also utilizing capital recycling, in which we engage in sustainable securitization and reinvestment of the funds generated. As strategies to achieve this, we will focus on "enhancing capital efficiency," "growth investment," and "structure creation."

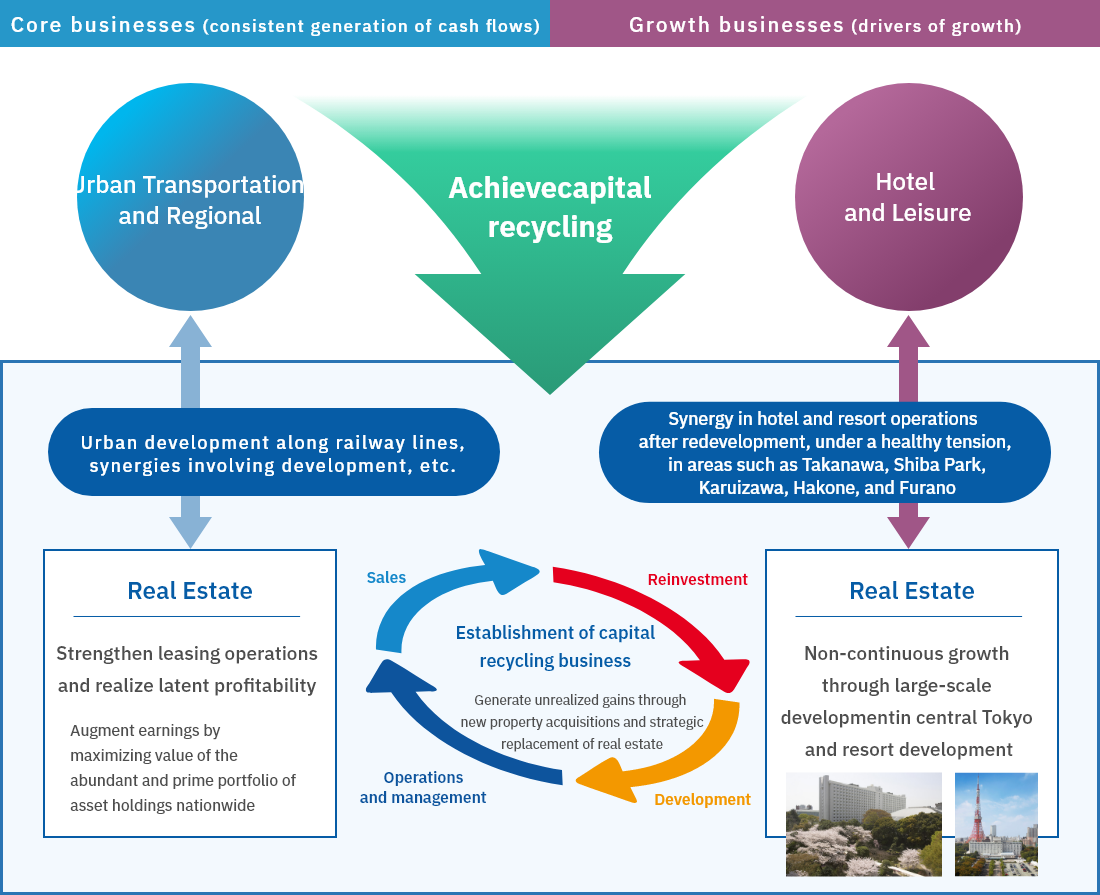

Recycle capital by rotating real estate

Main capital

Business Strategies

Enhance capital efficiency

We will conduct operations in the real estate business with a thorough emphasis on exceeding business-specific hurdle rates across the board. At the same time, using IRR for new development and acquisition properties, and ROIC for existing owned properties, we will aim for a balanced business portfolio between stable income (development and leasing) and sales profit (investment management). In this way, we will consciously enhance our efforts to achieve an operating profit balance of approximately 50-50 between the capital recycling business and existing businesses.

Growth investment

As a developer, we have a diverse portfolio of assets, through which we offer new feelings to customers in central Tokyo, the regions near the Seibu Line, and resort areas. We will manage our real estate portfolio with a steady hand, and clearly unlock its latent value through development and other means. We will also actively acquire new properties in line with strict investment criteria, add value to these properties, and secure capital gains.

Real Estate Structure

We will develop a four company structure, consisting of a developer, asset manager (AM), property manager (PM), and building manager (BM), to create a capital recycling business. In this way, we will enhance our expertise and strengthen competitiveness in the real estate business, as we aim to achieve our growth strategies.

Four company structurein the real estate business

-

SEIBU REAL ESTATE

Development

(holding, management, and development) -

- ・ This company will manage our real estate holdings and unlock the latent value of real estate through development.

- ・ This company will control our balance sheet by incorporating properties held and developed into private placement funds, etc.

- SEIBU REAL ESTATE ASSET MANAGEMENT Asset management (AM)

-

- ・ This company will maximize real estate value and secure stable investor profits through the use of pipelines and other means sponsored by the Group.

-

SEIBU REAL ESTATE PROPERTY MANAGEMENT

Management

(PM/CM, sales agency, and brokerage) -

- ・ This company will achieve efficient real estate management by handling PM and CM.

- ・ This company will seek to increase fee income from enterprises outside the Group and furthermore aim to gain more properties operated under management contract. This will involve entrusted property management with respect to properties acquired by the asset management company and M&As handled by the real estate management company.

- SEIBU REAL ESTATE BUILDING MANAGEMENT General building management (BM)

-

- ・ This company will provide safe, secure, and comfortable environments through facility equipment management and security and cleaning services.

- ・ It will aim to serve as a competitive building management company that gains more orders involving properties from outside the Group in seeking to further amass expertise.